In this article

Are you struggling to understand the complexities of FFIEC compliance? If so, you’ve come to the right place. In this comprehensive guide, we aim to demystify FFIEC compliance and provide you with everything you need to know to ensure your organization remains compliant.

The Federal Financial Institutions Examination Council (FFIEC) sets the standards for financial institution regulation and supervision. Compliance with these standards is crucial to protecting the security and integrity of your organization’s data.

In this article, we will break down the FFIEC requirements, guiding you through each step of the compliance process. We’ll cover the essential elements, such as risk assessments, audit controls, and security monitoring, so you can implement effective strategies that align with FFIEC regulations.

Whether you’re new to FFIEC compliance or looking to enhance your current practices, this guide will provide you with valuable insights and practical tips to navigate the complexities of this regulatory framework. Stay tuned, as we unravel the mystery of FFIEC compliance and equip you with the knowledge to safeguard your organization’s data and reputation.

Before diving into FFIEC compliance, it’s essential to understand the institution behind it. The FFIEC is not a regulatory body in and of itself; rather, it is a council comprised of various U.S. federal regulatory agencies, including the Office of the Comptroller of the Currency (OCC), the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), and the Consumer Financial Protection Bureau (CFPB).

The primary purpose of the FFIEC is to establish uniformity and consistency in the supervision and examination of financial institutions. It accomplishes this by developing and promoting regulatory guidelines and standards that these institutions must adhere to. The FFIEC also provides a framework for agencies to collaborate on issues of common interest.

What is FFIEC compliance?

FFIEC compliance, then, is the process by which financial institutions ensure they adhere to the regulations and guidelines set forth by the FFIEC. These regulations span a broad spectrum, covering areas such as information security, risk management, consumer protection, and more. Compliance is not optional; it is a legal obligation for financial institutions operating in the United States.

The aim of FFIEC compliance is to maintain the safety and soundness of financial institutions, protect consumer interests, and mitigate risks within the financial sector. To achieve these goals, FFIEC compliance places an emphasis on risk management and regulatory adherence.

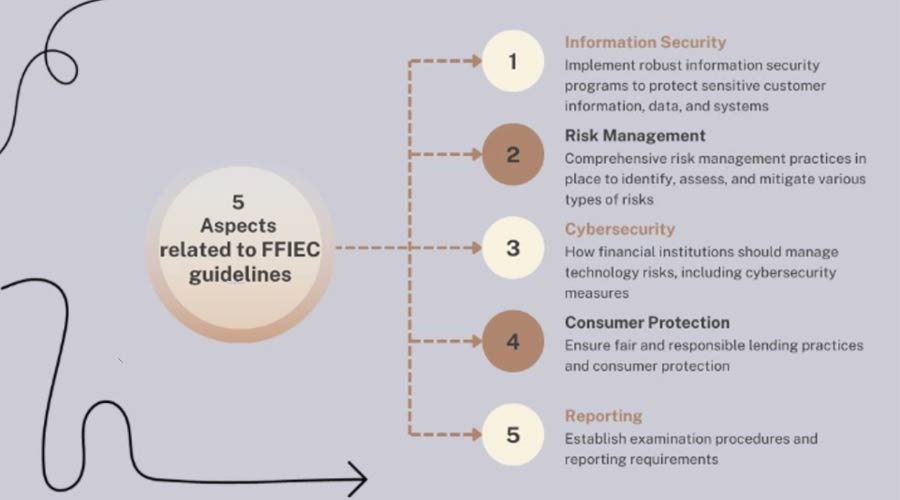

Five important aspects related to FFIEC guidelines:

The primary purpose of the FFIEC is to establish and promote uniformity and consistency in the supervision and examination of financial institutions, such as banks, credit unions, and savings associations. To achieve this goal, the FFIEC issues guidelines, standards, and regulations related to various aspects of financial institution operations, including:

- Information Security: FFIEC guidelines require financial institutions to implement robust information security programs to protect sensitive customer information, data, and systems from unauthorized access and data breaches.

- Risk Management: Financial institutions must have comprehensive risk management practices in place to identify, assess, and mitigate various types of risks, such as credit risk, operational risk, and compliance risk.

- Technology and Cybersecurity: FFIEC guidelines provide guidance on how financial institutions should manage technology risks, including cybersecurity measures, to protect their information technology infrastructure.

- Consumer Protection: The FFIEC also focuses on ensuring fair and responsible lending practices and consumer protection, covering areas such as fair lending, anti-money laundering (AML), and other consumer compliance regulations.

- Examination and Reporting: The FFIEC establishes examination procedures and reporting requirements that financial institutions must follow to demonstrate their compliance with regulatory standards.

Why FFIEC Compliance Matters

FFIEC compliance holds paramount significance in the financial sector for various reasons. First and foremost, it serves as a powerful mechanism for mitigating risks. With the help of risk assessment and management, FFIEC compliance helps safeguard the stability and integrity of financial institutions, reducing the potential for systemic failures and financial crises.

Secondly, it places a strong emphasis on consumer protection, ensuring that financial products and services are provided transparently and fairly. This commitment to consumer interests not only fosters trust within the industry but also enhances its overall stability. In an era characterized by digital threats and increasing regulatory complexities, FFIEC compliance is pivotal for bolstering cybersecurity, data protection, and business continuity.

Lastly, it enforces adherence to a complex web of federal and state regulations, helping financial institutions avoid legal complications, financial penalties, and reputational damage. Ultimately, FFIEC compliance is not merely a regulatory obligation; it is a linchpin in the financial sector’s mission to operate securely, transparently, and with the utmost integrity.

FFIEC compliance is not just a regulatory burden; it plays a critical role in the financial sector for several reasons:

- Risk Mitigation

By requiring financial institutions to assess and manage risks, FFIEC compliance helps protect the stability and safety of the financial sector. It reduces the likelihood of systemic failures and financial crises. - Consumer Protection

Consumer protection is at the heart of FFIEC compliance. It ensures that financial products and services are transparent and fair, which is essential for maintaining trust in the industry. - Regulatory Adherence

FFIEC compliance helps financial institutions adhere to a complex web of federal and state regulations. This is crucial for avoiding legal issues, fines, and reputational damage. - Cybersecurity

The emphasis on information security and IT risk management in FFIEC compliance is pivotal in an era where cyber threats are pervasive. Compliance helps institutions protect sensitive data and reduce the risk of data breaches. - Business Continuity

Business continuity planning ensures that financial institutions can continue to operate even in adverse conditions, such as natural disasters or pandemics. This is essential for maintaining financial stability.

How do I achieve FFIEC compliance in 5 steps?

Achieving compliance with the Federal Financial Institutions Examination Council (FFIEC) guidelines involves implementing a comprehensive cybersecurity program to protect sensitive financial information. Here are five steps to help your organization achieve FFIEC compliance:

- Understand FFIEC Guidelines:

Familiarize yourself with the FFIEC Cybersecurity Assessment Tool (CAT) and related guidelines. The CAT provides a structured framework for financial institutions to assess their cybersecurity maturity and identify areas for improvement. Understanding the guidelines is crucial for tailoring your cybersecurity program to meet FFIEC requirements. - Conduct Risk Assessments:

Perform regular risk assessments to identify and prioritize potential cybersecurity threats and vulnerabilities. The risk assessment should cover various aspects, including technology, personnel, processes, and external factors. Use the FFIEC CAT as a guide to assess your institution’s inherent risk and cybersecurity maturity levels. - Implement Security Controls:

Based on the risk assessments, implement robust security controls to mitigate identified risks. Ensure that your cybersecurity program covers key areas such as access controls, network security, incident response, data protection, and vendor management. Align your security controls with the FFIEC guidelines to address specific risks faced by financial institutions. - Develop an Incident Response Plan:

Establish a comprehensive incident response plan to address potential cybersecurity incidents promptly. The plan should include procedures for detecting, reporting, responding to, and recovering from security incidents. Test the incident response plan regularly through simulations and drills to ensure its effectiveness and the readiness of your organization to handle cyber threats. - Regularly Monitor and Update:

Implement continuous monitoring mechanisms to detect and respond to emerging cybersecurity threats in real-time. Regularly update your cybersecurity program to address new risks, technologies, and regulatory changes. Stay informed about the latest cybersecurity trends and best practices, and incorporate lessons learned from incidents or audit findings into your ongoing improvement efforts.

While these steps provide a general framework, achieving FFIEC compliance is an ongoing process that requires a commitment to cybersecurity best practices. Financial institutions should also consider engaging with cybersecurity experts, participating in information-sharing forums, and leveraging industry resources to stay current on evolving threats and regulatory requirements. Additionally, periodic audits and assessments, both internal and external, can help validate the effectiveness of your cybersecurity controls and ensure ongoing compliance with FFIEC guidelines.

Compliance with FFIEC regulations is essential for financial institutions to maintain the trust of customers, protect sensitive financial data, and avoid legal and regulatory sanctions. The FFIEC regularly updates its guidelines and standards to address evolving risks and challenges in the financial industry, making ongoing compliance efforts critical for institutions subject to its oversight.

Tools and technologies for FFIEC compliance management

Financial institutions can leverage various tools and technologies to streamline and enhance their FFIEC compliance management efforts. These tools can automate processes, provide real-time visibility, and simplify compliance documentation and reporting. Here are some commonly used tools:

- Governance, Risk, and Compliance (GRC) platforms: GRC platforms help financial institutions centralize their compliance efforts by providing a unified framework for risk management, policy management, audit management, and compliance reporting.

- Security Information and Event Management (SIEM) systems: SIEM systems collect and analyze security event logs from various systems and applications in real-time. They provide insights into potential security incidents and help organizations detect and respond to threats promptly.

- Vulnerability management tools: Vulnerability management tools automate the identification, assessment, and remediation of vulnerabilities in systems and applications. They help financial institutions proactively manage their security posture and address potential risks.

- Data loss prevention (DLP) solutions: DLP solutions monitor and control sensitive data to prevent unauthorized access, leakage, or loss. They help financial institutions comply with data protection regulations and maintain the confidentiality of customer information.

- Identity and access management (IAM) systems: IAM systems ensure appropriate access controls and identity verification processes are in place. They help financial institutions manage user access, enforce strong authentication, and monitor user activities.

- Security awareness training platforms: Security awareness training platforms provide interactive training modules and simulations to educate employees about cybersecurity best practices. These platforms track employee progress and provide metrics to assess training effectiveness.

Financial institutions should evaluate their specific compliance needs and select tools and technologies that align with their requirements and budget. It is essential to regularly assess the effectiveness of these tools and consider emerging technologies to meet evolving compliance challenges.

FFIEC compliance is paramount for financial institutions to protect customer data, maintain the integrity of financial systems, and meet regulatory requirements. Failure to comply with FFIEC guidelines can result in severe penalties, reputational damage, and loss of customer trust.

By understanding the key components of FFIEC compliance, implementing best practices, leveraging appropriate tools and technologies, and investing in training and resources, financial institutions can navigate the complexities of this regulatory framework and ensure ongoing compliance.

Remember, FFIEC compliance is not a one-time effort but an ongoing commitment. Staying up to date with regulatory changes, addressing evolving risks, and continuously improving compliance measures are essential to safeguarding your organization’s data and reputation in today’s rapidly changing cybersecurity landscape.

Read more Compliance & Cybersecurity Articles from TrustCloud.