Compliance gaps and their effective remediation techniques

Compliance gaps are the discrepancies between an organization’s current practices and the standards set by regulatory bodies or internal benchmarks. Compliance represents not just adherence to laws and regulations but also a commitment to ethical conduct and operational integrity. Across industries, the landscape of compliance is both vast and intricate, posing a continuous challenge for organizations striving to navigate its depths. Recognizing and addressing compliance gaps becomes a pivotal endeavor in this journey, ensuring that companies not only meet legal requirements but also uphold their reputations and safeguard their interests. This article aims to explore the realm of compliance gaps, shedding light on their implications, prevalent forms across industries, and the methodologies for their remediation.

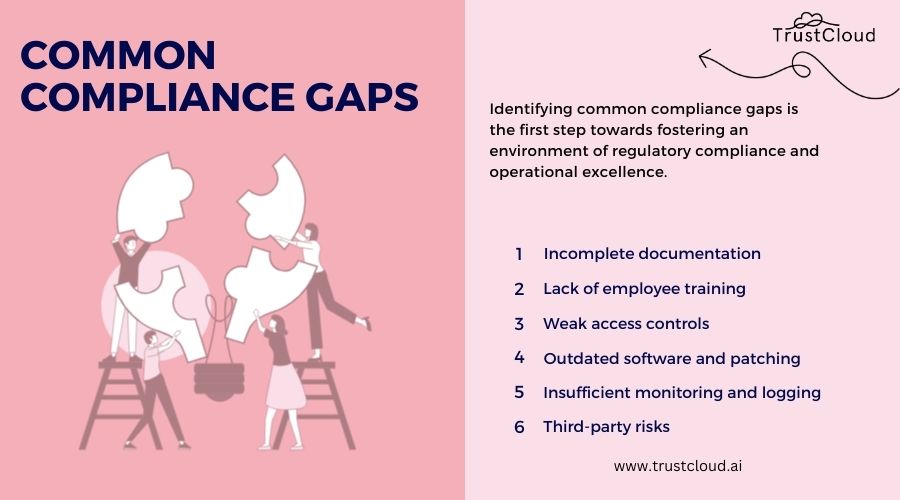

Achieving and maintaining compliance with regulatory standards is a top priority for organizations across industries. However, compliance gaps are not uncommon and can pose significant risks. In this article, we will explore common compliance gaps, understand their potential consequences, and provide detailed remediation techniques to help organizations address these gaps effectively.

Understanding compliance gaps

At the heart of compliance management lies the concept of common compliance gaps. Identifying these gaps is the first step towards fostering an environment of regulatory compliance and operational excellence. However, understanding compliance gaps extends beyond mere identification. It involves a deep dive into the nuances of regulatory requirements, an assessment of internal policies and procedures, and a recognition of the potential risks these gaps pose to an organization.

For you, the journey towards compliance begins with acknowledging that gaps might not only be external, in terms of non-compliance with laws and regulations, but also internal, reflecting shortcomings in meeting organizational standards or achieving best practices. This dual perspective is crucial for a holistic approach to compliance management. Each gap, irrespective of its nature, serves as a pointer towards areas of improvement, signaling opportunities for enhancing operational efficiency and regulatory adherence.

Engaging with compliance gaps thus requires a multifaceted strategy, incorporating thorough analysis, strategic planning, and effective implementation of remediation measures. The complexity of this endeavor is amplified by the dynamic nature of regulatory landscapes and the unique challenges posed by different industry sectors. However, with a comprehensive understanding of what compliance gaps entail and their implications, you are better positioned to embark on the path of remediation.

Here are common compliance gaps:

- Incomplete documentation:

- Issue: Insufficient or incomplete documentation of policies, procedures, and controls.

- Consequences: increased risk of non-compliance, difficulty in audits, and potential legal repercussions.

- Remediation Techniques:

- Conduct a comprehensive review of existing documentation.

- Implement a centralized document management system.

- Regularly update and maintain documentation.

- Lack of employee training:

- Issue: Inadequate training programs for employees on compliance requirements.

- Consequences: increased likelihood of human error, security incidents, and regulatory violations.

- Remediation Techniques:

- Develop and implement regular training programs.

- Ensure employees are aware of the latest compliance standards.

- Conduct phishing simulation exercises to test and improve employee awareness.

- Weak access controls:

- Issue: Ineffective access controls leading to unauthorized access to sensitive information.

- Consequences: data breaches, privacy violations, and regulatory fines.

- Remediation Techniques:

- Conduct regular access reviews and audits.

- Implement strong authentication measures.

- Utilize role-based access controls to limit permissions.

- Outdated software and patching:

- Issue: Failure to regularly update and patch software, leaving vulnerabilities exposed.

- Consequences: increased risk of cyberattacks, data breaches, and non-compliance.

- Remediation Techniques:

- Establish a robust patch management process.

- Regularly monitor and apply software updates.

- Conduct vulnerability assessments to identify and remediate weaknesses.

- Insufficient monitoring and logging:

- Issue: Inadequate monitoring of systems and networks leads to undetected security incidents.

- Consequences: delayed incident response, increased impact of breaches, and compliance violations.

- Remediation Techniques:

- Implement continuous monitoring solutions.

- Set up centralized logging and analysis.

- Regularly review and analyze security logs.

- Third-party risks:

- Issue: Failure to assess and manage risks associated with third-party vendors.

- Consequences: exposure to security breaches, data loss, and regulatory penalties.

- Remediation Techniques:

- Conduct thorough due diligence when selecting vendors.

- Establish clear contractual agreements on security standards.

- Regularly assess and monitor third-party compliance.

Importance of closing compliance gaps

The significance of addressing compliance gaps cannot be overstated. Beyond the immediate benefit of avoiding legal penalties and fines, closing compliance gaps plays a critical role in building a robust framework for sustainable business operations. It is a testament to an organization’s commitment to ethical practices, quality, and reliability – attributes that are invaluable in today’s competitive market.

For you, closing compliance gaps means safeguarding your organization against the risks of non-compliance, which include legal repercussions, financial losses, and reputational damage. These risks, if left unaddressed, can have far-reaching implications, affecting stakeholder trust and the long-term viability of your business. Moreover, in an era where consumers and clients are increasingly conscious of corporate responsibility, ensuring compliance is integral to maintaining brand integrity and customer loyalty.

Furthermore, the process of identifying and remediating compliance gaps fosters a culture of continuous improvement within organizations. It encourages a proactive approach to risk management, prompting you to regularly review and update policies, procedures, and practices in alignment with evolving regulatory requirements and industry standards. This not only enhances operational efficiency but also positions your organization as a leader in compliance and governance.

Common compliance gaps in various industries

Compliance gaps manifest differently across industries, shaped by the unique regulatory challenges and operational complexities each sector faces. In the financial services industry, for example, common compliance gaps often relate to anti-money laundering (AML) protocols, data protection policies, and consumer financial rights. The healthcare sector, on the other hand, grapples with gaps pertaining to patient privacy under the Health Insurance Portability and Accountability Act (HIPAA), clinical trial regulations, and pharmaceutical marketing practices.

For you, understanding the specific compliance challenges inherent to your industry is crucial for effective gap analysis and remediation. In the technology sector, issues around data security, intellectual property rights, and ethical AI use are prevalent. Meanwhile, manufacturing firms frequently encounter gaps in environmental regulations, workplace safety standards, and product quality controls.

This variability underscores the importance of industry-specific knowledge and expertise in compliance management. It demands a tailored approach to identifying and addressing gaps, one that considers the regulatory landscape, operational realities, and the strategic objectives of your organization. Embracing this specificity is key to developing effective remediation techniques that not only close existing gaps but also prevent the emergence of new ones.

Conducting a compliance gap analysis

Conducting a compliance gap analysis is a systematic process that enables you to identify and assess the discrepancies between your organization’s current practices and the required compliance standards. This involves a comprehensive review of existing policies, procedures, and controls, juxtaposed against regulatory requirements and best practices. The goal is to pinpoint areas of non-compliance, evaluate their significance, and develop a clear understanding of the steps needed to bridge these gaps.

For you, the process begins with gathering pertinent information, which may include regulatory guidelines, industry standards, and internal documentation. This is followed by an evaluation of your organization’s compliance posture, identifying areas where practices fall short of requirements. The analysis should be thorough and unbiased, ensuring that even subtle discrepancies are uncovered.

The outcome of a compliance gap analysis provides a roadmap for remediation, highlighting priorities and guiding the allocation of resources. It is a critical step in the journey towards compliance, laying the groundwork for the development of a comprehensive remediation plan.

Developing a comprehensive remediation plan

Once compliance gaps have been identified and analyzed, the next step for you is to develop a comprehensive remediation plan. This plan should detail the specific actions required to address each identified gap, assign responsibilities for implementation, and establish deadlines for completion. It should also outline the resources necessary for the plan’s execution, including financial, human, and technological.

For you, developing a remediation plan is not just about addressing immediate compliance issues. It’s about building a sustainable framework for ongoing compliance management. This includes setting up mechanisms for monitoring and continuous improvement, ensuring that your organization remains adaptable to changes in regulatory requirements and industry standards.

The plan should be documented and communicated clearly to all stakeholders involved. This ensures transparency and accountability, fostering a shared commitment to achieving compliance objectives.

Remediation techniques for compliance gaps

The process of remedying compliance gaps involves a series of strategic steps, each aimed at transforming identified deficiencies into areas of strength and compliance. The initial phase entails a deep analysis of the gaps, understanding their root causes, and assessing their impact on the organization. This is followed by the development of a targeted action plan, outlining the measures required to address each gap, the resources needed, and the timelines for implementation.

For you, prioritizing the identified gaps based on their risk level and impact on the organization is crucial. This ensures that resources are allocated efficiently, focusing efforts on areas that pose the greatest threat to operational integrity and regulatory compliance. Remediation techniques may involve revising internal policies and procedures, enhancing training and awareness programs, implementing new technologies, or re-engineering business processes to align with compliance requirements.

Effective remediation also requires a collaborative effort, engaging stakeholders across various levels of the organization. This not only facilitates the seamless implementation of remediation measures but also fosters a culture of compliance, embedding regulatory adherence into the fabric of organizational practices and values.

Here are a few remediation techniques for compliance gaps:

- Conduct comprehensive risk assessments:

- Identify and Prioritize Risks: Perform regular risk assessments to identify and prioritize potential compliance risks.

- Implement Mitigation Plans: Develop and implement mitigation plans based on the identified risks.

- Continuous Monitoring: Establish continuous monitoring processes to adapt to evolving risks.

- Enhance documentation processes:

- Regular Audits: Conduct regular audits of documentation to ensure it’s completeness and accuracy.

- Automation Tools: Use automation tools for document management and version control.

- Training Programs: Train employees on the importance of maintaining updated documentation.

- Invest in employee training and awareness:

- Regular Training Sessions: Provide regular training sessions on compliance requirements and best practices.

- Simulated Exercises: Conduct simulated exercises, such as phishing tests, to gauge employee awareness.

- Feedback Mechanism: Establish a feedback mechanism for employees to report potential compliance issues.

- Implement robust access controls:

- Regular Access Reviews: Conduct regular access reviews to ensure appropriate permissions.

- Role-Based Access Controls: Implement role-based access controls to limit access to necessary functions.

- Two-Factor Authentication: Enforce the use of two-factor authentication for enhanced security.

- Prioritize software updates and patch management:

- Automated Patching: Utilize automated patch management systems for timely updates.

- Vulnerability Scans: Conduct regular vulnerability scans to identify and address weaknesses.

- Risk-Based Approach: Prioritize patching based on the severity and criticality of vulnerabilities.

- Enhance monitoring capabilities:

- Real-Time Monitoring: Implement real-time monitoring solutions for early detection of security incidents.

- Incident Response Plans: Develop and regularly test incident response plans for swift action.

- Continuous Improvement: Continuously improve monitoring capabilities based on evolving threat landscapes.

- Manage third-party risks effectively:

- Comprehensive vendor assessments: Conduct comprehensive assessments of third-party vendors before engagement.

- Regular Audits: Regularly audit and assess third-party compliance with security standards.

- Contractual Safeguards: Include clear security requirements in vendor contracts, specifying compliance expectations.

Implementing remediation strategies

The successful implementation of remediation strategies hinges on careful planning, effective management, and the engagement of key stakeholders. For you, this involves allocating the necessary resources, setting realistic timelines, and establishing clear lines of communication and accountability. It also requires a proactive approach to managing potential challenges and obstacles that may arise during the implementation phase.

Effective implementation is characterized by flexibility and adaptability, allowing for adjustments to the remediation plan as necessary. This agility is crucial for responding to unforeseen issues or changes in the compliance landscape. For you, it means maintaining a constant state of vigilance and readiness, ensuring that your organization can swiftly adapt its compliance strategies in the face of evolving regulations and operational dynamics.

In addition, leveraging technology can play a pivotal role in enhancing the efficiency and effectiveness of remediation efforts. Compliance management systems, for instance, can automate many aspects of compliance monitoring and reporting, freeing up valuable resources to focus on strategic compliance initiatives.

Monitoring and evaluating the effectiveness of remediation efforts

The remediation process does not end with the implementation of strategies. For you, it is imperative to establish mechanisms for ongoing monitoring and evaluation, ensuring that remediation efforts are producing the desired outcomes. This involves setting up key performance indicators (KPIs) and benchmarks for compliance, which can be used to measure the effectiveness of remediation efforts over time.

Regular reviews and audits should be conducted to assess progress and identify areas where further improvement is needed. For you, this is an opportunity to refine your compliance strategies, making adjustments based on empirical evidence and operational insights. It also serves as a means of demonstrating compliance to regulatory bodies, stakeholders, and the public, reinforcing your organization’s commitment to ethical practices and regulatory adherence.

Monitoring and evaluation also play a critical role in fostering a culture of continuous improvement within organizations. For you, it encourages a proactive approach to compliance management, where lessons learned from remediation efforts are integrated into future strategies, ensuring that your organization remains at the forefront of compliance excellence.

Case Studies: real-world remediation success stories

Examining case studies of successful remediation efforts provides valuable insights into the practical application of the strategies and techniques discussed. These stories not only highlight the challenges faced by organizations in achieving compliance but also showcase the innovative solutions and best practices that led to their success.

For you, these case studies serve as a source of inspiration and guidance, offering practical examples of how compliance gaps can be identified, analyzed, and effectively remediated. They illustrate the importance of a comprehensive approach to compliance management, emphasizing the role of leadership, collaboration, and continuous improvement in achieving regulatory adherence and operational excellence.

By learning from the experiences of others, you can refine your own compliance strategies, avoiding common pitfalls and leveraging proven techniques to enhance your organization’s compliance posture. Here are some examples, you can learn from:

- Target data breach:

- Issue: Target experienced a massive data breach due to weaknesses in its third-party vendor’s systems.

- Remediation: Target implemented enhanced third-party risk management protocols, including regular assessments and contractual safeguards.

- GDPR compliance gap:

- Issue: A company faced GDPR compliance gaps related to data handling and consent management.

- Remediation: The organization conducted a thorough risk assessment, revamped documentation processes, and implemented employee training programs to address GDPR requirements.

Building a culture of continuous improvement

Building a culture of continuous improvement is pivotal for sustained success in any organization. It entails fostering an environment where every member is encouraged to innovate, learn, and refine processes regularly. Embracing feedback, both constructive and positive, is essential. By promoting transparency and accountability, teams can identify areas for enhancement and implement iterative changes efficiently.

Cultivating a growth mindset across all levels nurtures adaptability and resilience in the face of challenges. Emphasizing the value of incremental progress empowers individuals to strive for excellence consistently. Ultimately, a culture of continuous improvement not only drives organizational growth but also fosters individual development and fulfillment.

- Leadership involvement:

- Top-Down Support: Demonstrate a leadership commitment to continuous improvement in compliance.

- Resource Allocation: Allocate resources for ongoing training, technology upgrades, and process enhancements.

- Continuous training and awareness:

- Regular Updates: Keep employees informed about evolving compliance standards and best practices.

- Feedback Loops: Establish feedback loops to gather insights from employees on potential gaps and improvement areas.

- Performance metrics and reporting:

- Key Performance Indicators (KPIs): Define and measure KPIs related to compliance, including incident response times and the completion of training programs.

- Reporting Mechanism: Implement a robust reporting mechanism to communicate compliance status to stakeholders.

- Regular audits and assessments:

- Periodic Reviews: Conduct periodic internal audits and assessments to identify and rectify emerging compliance gaps.

- External Audits: Engage external auditors to provide an unbiased assessment of compliance efforts.

Conclusion: Closing the Gap and Maintaining Compliance

In the complex and ever-changing landscape of regulatory compliance, closing compliance gaps is an ongoing challenge that demands diligence, strategic planning, and a commitment to continuous improvement. For you, the journey towards compliance is not a one-time endeavor but a continuous process of monitoring, evaluation, and adaptation.

By understanding the importance of compliance gaps, recognizing their common forms across industries, and applying effective remediation techniques, you can not only address current deficiencies but also build a robust framework for future compliance. This involves conducting thorough gap analyses, developing comprehensive remediation plans, implementing strategies effectively, and continuously monitoring the effectiveness of your efforts.

The journey toward closing the gap and maintaining compliance is both challenging and rewarding. It requires a concerted effort from all levels of the organization, a commitment to ethical practices, and a proactive approach to compliance management. However, with the right strategies and a dedication to excellence, you can navigate the complexities of compliance with confidence, ensuring the long-term success and integrity of your organization.

Addressing common compliance gaps requires a multifaceted and proactive approach. By understanding the root causes, implementing remediation techniques, and fostering a culture of continuous improvement, organizations can enhance their compliance posture, reduce risks, and build resilience in the face of evolving regulatory landscapes.

Compliance is not a one-time effort but an ongoing commitment to maintaining the highest standards of security, integrity, and transparency.

Join our TrustCommunity to learn about security, privacy, governance, risk and compliance, collaborate with your peers, and share and review the trust posture of companies that value trust and transparency!Want to see how to turn GRC into a profit center?

Ready to save time and money on audits, pass security reviews faster, and manage enterprise-wide risk? Let’s talk!Want to learn more about GRC?

Explore our GRC launchpad to gain expertise on numerous compliance standards and topics